Resilience in the Markets: Key Updates in Q4

As we enter the year's final quarter, financial markets and the economy have defied investors' expectations. Rather than falling into recession, the economy has grown steadily, albeit more slowly, and inflation rates have fallen toward the Fed's 2% target. As a result, the macroeconomic environment is signaling a monetary easing cycle, propelling broad market indices to new all-time highs and boosting bond returns. Of course, there are always risks on the horizon to consider.

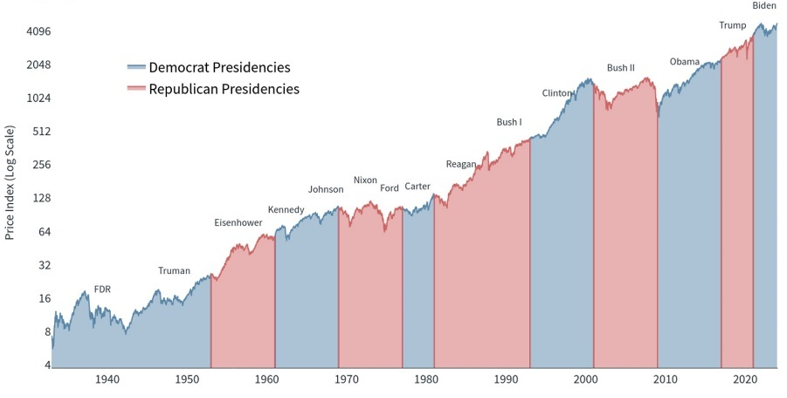

The market has performed well under both political parties

Many investors are concerned about the potential impact of the presidential election on the economy. History shows that the stock market has experienced long-term growth under both major political parties, as seen in the accompanying chart. It is not the case that the market or economy crashes when one political party is in office. Rather, the underlying drivers of market performance – economic cycles, earnings, valuations, etc. – are far more important than who occupies the White House.

The Stock Market and Presidencies

S&P 500 price returns on a log scale with presidents and their parties highlighted since 1933

Latest data point is Dec 31, 2023

Source: Clearnomics, Standard & Poor’s

© 2024 Clearnomics

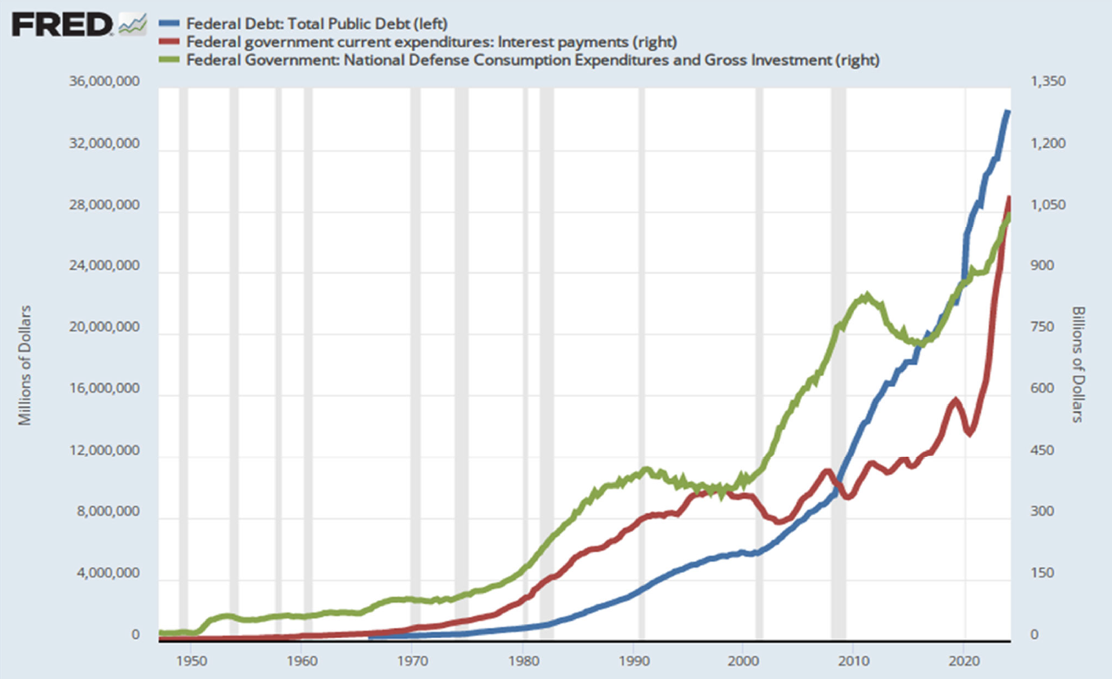

The federal deficit remains an unchecked concern

Substantial levels of deficit spending support economic growth, but at a significant cost, with interest expense doubling in just three years to over $1 trillion annually. According to the Congressional Budget Office, government spending accounted for 24% of economic growth in 2023, the highest share of economic activity since World War II. This level of spending cannot be sustained in the long term.

Source: Treasury; BEA

© 2004-2024 Towneley Capital Management, Inc. All rights reserved. Any use, including reproduction, modification, distribution, or republication, without prior written consent of Towneley Capital Management, is strictly prohibited.

Although worrisome, geopolitical conflicts do not directly impact markets

Tensions are rising in the Middle East as the conflict between Israel and Hezbollah has intensified, boosting global geopolitical tensions, including the ongoing war between Russia and Ukraine. While these events have major real-world impacts, their effects on the economy and the stock market are less clear, and any impact on investors' portfolios is typically fleeting. Despite geopolitical uncertainties, the stock market has experienced only two pullbacks this year of at least 5%, emphasizing the importance of staying invested and focusing on broader market trends rather than reacting to headlines.

The Interest rate landscape is shifting

As inflation moderates, the Fed is expected to lower interest rates further over the coming months. The most recent data showed that the Personal Consumption Expenditures price index, the Fed's preferred inflation measure, increased by just 2.2% from a year earlier, approaching the Fed's target 2% rate. Meanwhile, the labor market showed continued signs of slowing, with unemployment at 4.2%, still low by historical standards. For the economy, lower interest rates reduce borrowing costs for corporations and individuals, potentially boosting economic expansion and investment prospects. This can be positive for economic growth, translating into better corporate earnings.

The bottom line

With the election on the horizon, increasing geopolitical tension, and interest rates dropping, staying focused on your long-term financial goals rather than short-term events is more important than ever.