Finding Good Amid The Bad and The Ugly

Investors faced historic challenges during the first quarter as domestic equity markets fell into correction territory following an exceptional two years of performance. Red hot inflation, a Fed rate hike, Russia's invasion of Ukraine, and steeply rising oil prices contributed to a volatile three months. Year-to-date through March, the S&P 500 declined 5%, the Dow dropped 4.6%, and the Nasdaq fell 9.1%. Despite these events, markets stabilized and bounced back during the final weeks of the quarter.

Taking all of this into account, how can long-term investors remain patient and focused after such a difficult start to the year?

“It ain’t what you don’t know that gets you in trouble; it’s what you know for sure that just ain’t so”

As Mark Twain said, "it ain't what you don't know that gets you into trouble; it's what you know for sure that just ain't so." Markets incorporate a constant flow of new information into asset prices. However, it is often problematic when markets expect one thing and get another. In the case of the Fed's rate increase, the situation played out as many expected. But this was not the case with the impact of Russia's war with Ukraine.

Markets widely expected the Fed to begin raising policy rates and end its asset purchase program in response to rising inflation and strong economic growth. In March, the Fed approved a 0.25% rate hike, the first since 2018. However, as inflation continued to rise, the Federal bankers conceded they underestimated how long pandemic price pressures would last.

Markets now expect the Fed to accelerate its pace of tightening in the coming months. The Fed's last set of projections suggests that the Fed Funds rate will reach 1.75% by the end of the year, whereas more recent statements by Fed officials and Fed Funds futures suggest that 2.5% is more likely. With housing prices, commodity prices, and the producer price index rising, inflation could remain elevated for several months. As a result, many expect the Fed to approve 50 basis point rate hikes at upcoming meetings as they try to halt inflation's upward trajectory.

After the Fed raised the policy rate, the S&P 500 Index rebounded 8.6% during the second half of March, while the Nasdaq gained 13%. However, both indexes are still negative year-to-date, and the Nasdaq remains in correction territory. The stock market's behavior reminds us that the Fed tends to raise rates during economic expansions. Especially now, higher interest rates are justified given the strong economy and rising prices. It also demonstrates that market upswings can occur when investors least expect them and often when the situation seems dire.

Perhaps the most persistent impact of the Fed's change in policy is the effect on interest rates. The 10-year Treasury yield rose above 2% for the first time since the pandemic began. From the 2-year and longer periods, much of the yield curve has flattened completely. The yield curve even "inverted" briefly, an occurrence that many economists use to predict a recession, although there is often a long lead time before the economy truly decelerates.

The yield curve's trajectory matters because interest rates affect all parts of the economy and reflect underlying economic trends. The yield curve tends to flatten in a maturing business cycle as short-term rates catch up to long-term rates. As the yield curve flattens, economic growth tends to slow, and borrowing costs tend to rise, which helps prevent the economy from overheating. Currently, interest rates are still relatively low by historical standards, especially with inflation at its highest level since the early 1980s.

Unlike the Fed's recent rate increase, the conflict in Ukraine surprised financial markets and altered investors' expectations of risk and energy prices. While the situation is still evolving, the impact on markets has shifted. Initially, in response to the invasion, markets roiled, and oil prices spiked as the cost of Brent crude rose to $128 per barrel. However, as Ukraine has stood its ground in many major cities, markets have stabilized, and oil prices declined.

While every geopolitical crisis is different, history shows that markets eventually adjust and move forward, as they did during Russia's annexation of Crimea, the wars in Afghanistan and Iraq, and 9/11. Markets also adapted during the Cold War and throughout other 20th-century conflicts.

While we are not out of the woods, investors should remain focused and disciplined during these challenging times. The first quarter underscores that investing requires taking the good with the bad and the ugly. Historically, long-term investors have been rewarded because they stuck it out during difficult times. Below are five charts to remind us of what is still good as we move through the rest of 2022.

Long-Term Stock Market Performance Remains Positive

The reality is that the S&P 500 and other major stock indices have performed well over the last several years. Although the index is negative for the year so far, the S&P 500 has gained 96% since the pandemic crash and 34% since the pre-pandemic peak.

Latest data point is Apr 18, 2022

Source: Clearnomics, Standard & Poor’s, New York Times

©2022 Clearnomics, Inc.

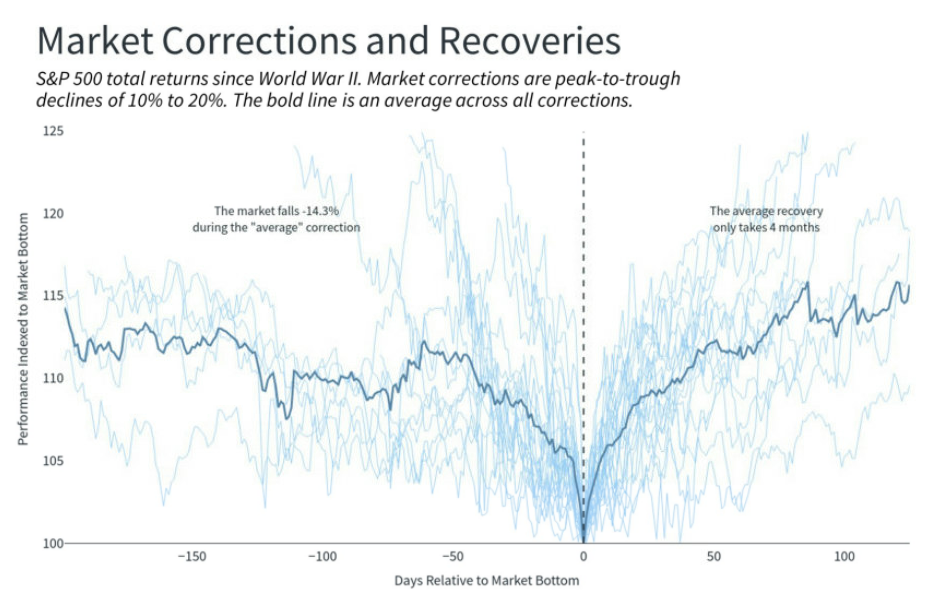

Historically, Market Corrections are Short-Lived

Stock market corrections are not only normal, but they are unavoidable. Remember that market recoveries can begin without notice and often when the situation seems most dire. But the average recovery lasts only four months. So, long-term investors benefit from staying invested during downturns and not reacting to short-term events.

Source: Clearnomics, Standard & Poor’s

©2022 Clearnomics, Inc.

Markets Can Adjust Quickly to Geopolitical Events

Historically, geopolitical events have had a mixed effect on financial markets. For example, in the 12- months following Russia’s annexation of Crimea, the US stock market gained 13%. During the first six months following the 9/11 attacks--which occurred during the dot-com bear market--the US stock market gained 7%, but then declined over the next six months to finish the 12-month period down 17%. Regardless of the direction the market moved initially following each event presented in the chart below, its response was quick and, in most cases, positive one year later

Source: Clearnomics, Standard & Poor’s

©2022 Clearnomics, Inc.

Rising Yields Mean More Income for Bond Investors

Although the first quarter has been challenging for bonds, the good news is that yields are higher and, in many cases, above long-run averages. Higher bond yields mean more income and higher fixed income returns in the future, which benefits those who rely on interest income, such as many retirees.

Latest data point is Mar 31, 2022

Source: Clearnomics, Standard & Poor’s

©2022 Clearnomics, Inc.

More People Are Working

Job growth has been torrid since the pandemic losses, due primarily to escalating consumer demand. Employers hired an additional 431,000 workers in March 2022, and the jobless rate fell from 3.8% to 3.6%, edging closer to the 50-year pre-pandemic low of 3.5%. Low unemployment can lead to wage increases and inflationary pressures but is generally positive for the economy.

Note: Seasonally adjusted

Source: Labor Department

Thoughts from Towneley

Despite the many bad and ugly events in this world, we urge you to stay focused on the good, including achieving your long-term goals. Recent negative headlines and increased market volatility underscore the importance of following a disciplined, diversified investment approach and avoiding predictions and market timing. Rather than trying to predict future market moves, remember that relevant information is quickly factored into market valuations.

We have traversed many market cycles with our clients and, as always, we urge you to stay the course. However, if you are experiencing changes in your life or organization that might alter your long-term goals or cash flow needs, please let your portfolio manager know so we can evaluate whether your portfolio allocation should be adjusted.