STOCK MARKET EXTREMES AND PORTFOLIO PERFORMANCE

A study commissioned by Towneley Capital Management and conducted by Professor H. Nejat Seyhun, University of Michigan.

Letter from Dr. Wesley G. McCain

This study has an unusual origin, one that underscores just how little is really known about abrupt market swings and their effects on a portfolio's performance.

Earlier this year, my colleagues and I at Towneley Capital Management were looking at a published chart which took a statistical view of how an investor could suffer for missing periods of a bull market. That chart, which is fairly well known in the investment community, is usually attributed to the University of Michigan. We wanted some additional data about the penalty for sitting on the sidelines at any time during a rising market, so we took what we thought was the easiest route: We called the University of Michigan School of Business Administration at Ann Arbor.

Here is where the events took a strange turn. While the professors we contacted had seen the chart, they said that no one at the school had ever published those numbers or done such a study. In fact, they said that they had received many phone calls over the years asking about the chart. All callers came away disappointed.

We decided to correct this situation. We commissioned Dr. H. Nejat Seyhun, Professor of Finance and Chairman of the Finance Department at the University of Michigan, to perform a comprehensive study of the effect of daily and monthly market swings on a portfolio's performance. To measure the effect of those swings, we looked at two time periods -- 1926-1993 and 1963-1993.

The results were startling. It is well known that the market does not rise or fall steadily. Instead, there are days or months when the market soars or plunges. But what surprised us was that a tiny portion of those brief swings accounts for practically all of a market's gains or losses over decades. For example, 95% of the market gains between 1963 and 1993 stemmed from the best 1.2% of the trading days!

Market timing, then, is perhaps even more difficult and risky than investors have been led to believe. Every time an investor defers funding an IRA or a 401(k) plan "until the market gets better," that investor is trying to time the market. Yet waiting can mean missing the crucial days or months when the market surges -- a narrow window of opportunity most investors probably cannot anticipate.

That is why we at Towneley believe that investors can better attain their financial goals through an investment program based on asset allocation, managed risk, and diversification of investment styles.

We leave market timing to those who feel more comfortable than we do about predicting the future.

Sincerely,

Wesley G. McCain, Ph.D., CFA

Highlights of the Study

This comprehensive study looks at stock market turbulence and how it can affect investment performance.

Professor Seyhun studied stock market returns and risk for all months from 1926 through 1993, and for all trading days from 1963 through 1993. His findings highlight the challenge of market timing, since a small number of months or days accounted for a large percentage of market gains and losses. For example:

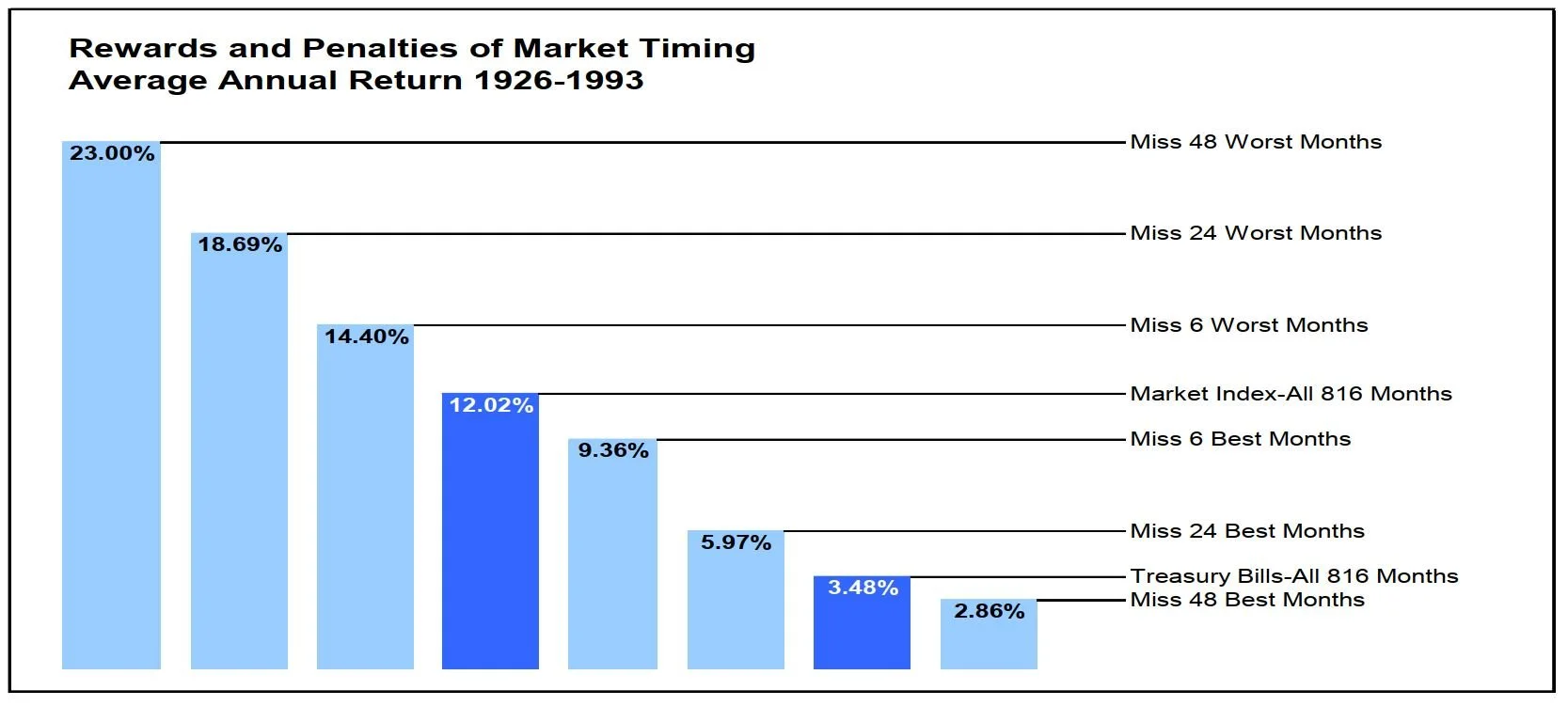

From 1926-1993, a capitalization weighted index of U.S. stocks gained an average of 12.02% annually. An initial investment of $1.00 in 1926 would have earned a cumulative $637.30. If an investor missed the market's best 12 of the 816 months, the annual return falls to 8.07% and the cumulative earnings to $65.00. Missing the best 48 months, or 5.9% of all months, reduces the annual return to 2.86% and the cumulative gain to $1.60.

Avoiding months when the market plummets can, of course, greatly improve performance. Excluding the single worst month raises the average annual return to 12.51% and the cumulative return to $898.00. Eliminating the 48 worst months lifts the annual return to 23.0% and the cumulative amount to $270,592.80.

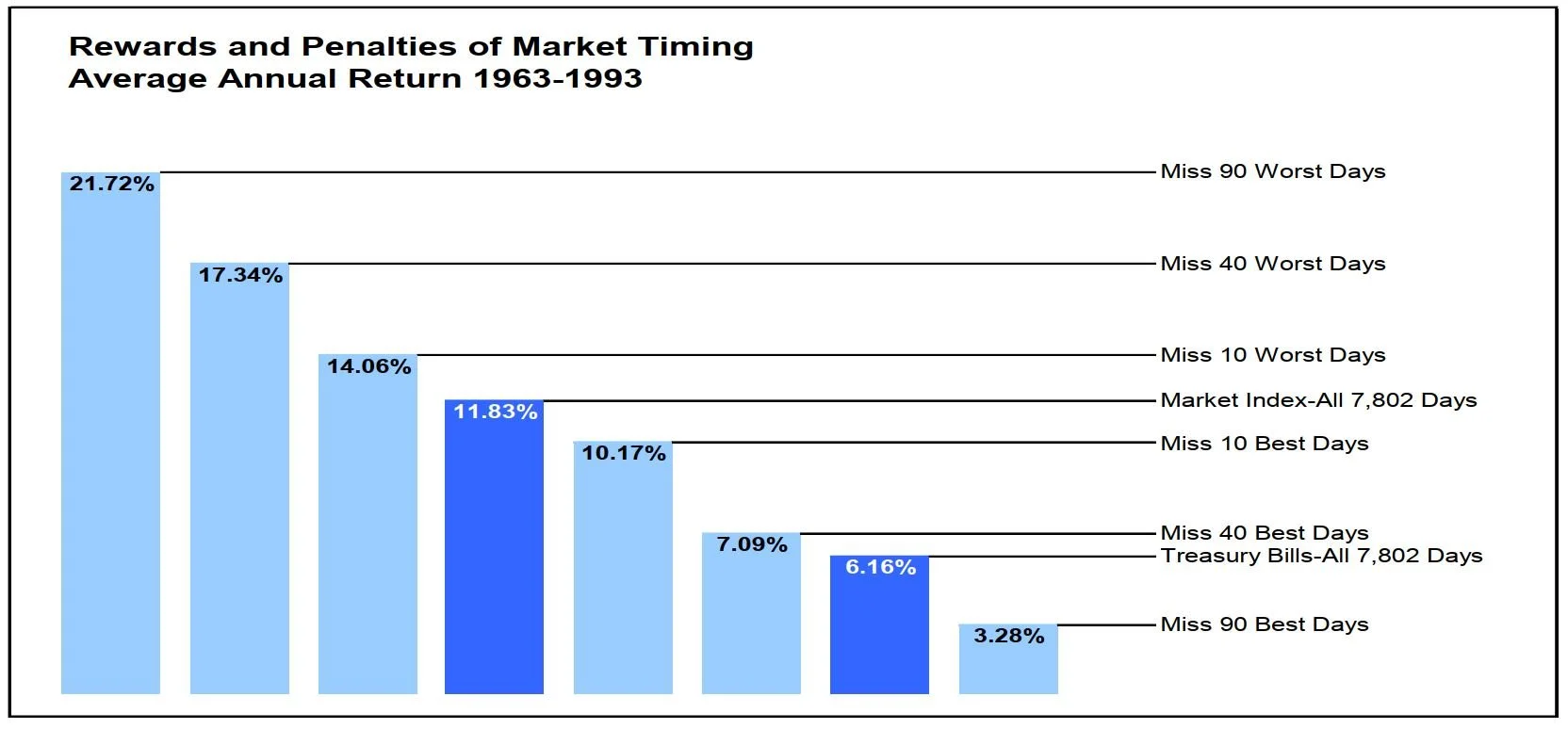

For the 1963-1993 time frame, the findings were similar. The index gained at an average annual rate of 11.83%, for a cumulative return on $1.00 of $23.30 over 31 years. If the best 90 trading days, or 1.2% of the 7,802 trading days, are set aside, the annual return tumbles to 3.28% and the cumulative gain falls to $1.10.

If the 10 worst days are eliminated, the annual return jumps to 14.06%, and the cumulative return increases to $44.80. With the 90 worst days out, the annual return rises to 21.72% and the cumulative gain to $325.40.

Close examination of the study's data also shows that:

In the 1926-1993 period, missing the best 5.9% of the months (a total of 48 months) would have created exposure to 83% of the risk of continuous stock market investing, but the average annual return would have been 19% less than the return on Treasury bills.

In the 1963-1993 span, missing the best 0.8% of the days (a total of 60 days in all) created an exposure to 94% of the risk of continuous stock market investing. In this situation, the average annual return would have been 11% less than that of Treasury bills.

Introduction

Even a cursory glance at stock market line graphs makes it clear that the market does not rise or fall steadily. For short periods it may skyrocket or plunge. While experience suggests that these short periods are critically important for long-term investment results, Towneley Capital Management decided to actually measure their importance.

At the request of Towneley Capital Management, Professor H. Nejat Seyhun, Chairman of the Finance Department of the University of Michigan School of Business Administration, undertook a comprehensive examination of the years 1926-1993 and 1963-1993.

Professor Seyhun looked at the broad market for U.S. stocks during these time frames and produced findings that are current and comprehensive. He quantified both return and risk, and compared the results of continuous full investment and what would happen if an investor was out of the market during the relatively brief periods of sharpest fluctuations. In this study, the months and days with the widest swings are called stock market "extremes."

The Problem

For a number of investors, an acceptable investment strategy includes market timing -- in other words, owning stocks in a rising market and moving to cash and cash equivalents when the market falls.

But if most of the market's gains come during a very brief time, the risks of market timing are enormous. Substantial payoffs would be rare and easy to miss. Sharp downturns also would be infrequent and hard to avoid. The challenge of moving in and out of the stock market at all the right times would be immense.

The study was designed to throw light on just how difficult it is to time market fluctuations correctly. And while it clearly shows how wonderful results can be for successfully timing the market, it is sobering to consider the penalties for being wrong.

Market Timing: A Definition

In this study, market timing is defined as an investment strategy that transfers assets from equities to cash equivalents, or from cash equivalents to equities, based on a prediction of the direction and extent of the next price movement in the equity market.

Successful market timing would require not only foretelling the future correctly most of the time but also moving back and forth between equities and cash (or cash equivalents) without incurring prohibitive transaction costs.

Methodology

Professor Seyhun studied return and risk data for an index of U.S. stocks. Return was measured as total return with dividends reinvested. Risk was measured by calculating the standard deviation of the total returns.

Two periods were examined: 1926-1993 and 1963-1993. The first period covers the full time frame for which monthly data are available. The second period covers all 31 calendar years for which daily data are available.

The index was a capitalization weighted composite of stocks traded on the New York Stock Exchange (NYSE), American Stock Exchange (ASE) and the National Association of Securities Dealers Automated Quotation system (NASDAQ). NYSE data were available for both periods; ASE data from July 1962; NASDAQ data from December 1972.

The number of stocks in the index and the market value of the index increased over time. On the last trading day of 1993, data were included on 7,525 stocks with a market value in excess of $5 trillion.

The study also looked at the returns on one-month Treasury bills for all periods.

For each period studied, total return for the index was calculated both as a cumulative figure and as an average annual rate of return. (See Tables A and B for a description of rate of return calculations.)

The study examined what would have happened to the index performance and risk data if a number of the market's best and worst months and days - the stock market extremes -were eliminated from the calculations. Naturally, "best" means the months or days with the highest returns; "worst" the lowest or most negative returns.

Results were calculated in three ways: excluding only best days, excluding only worst days and excluding a combination of best and worst days.

A final calculation was the risk and reward of two hypothetical market timers. The perfect timer owned stocks - that is, was "in the market" in all the periods with positive returns and held Treasury bills when stock returns were negative. The inept timer owned stocks only when returns were negative and was "out of the market" - that is, owned Treasury bills - when the stock market was positive. This exercise quantifies the ultimate extent that market timing might have rewarded or punished its practitioners.

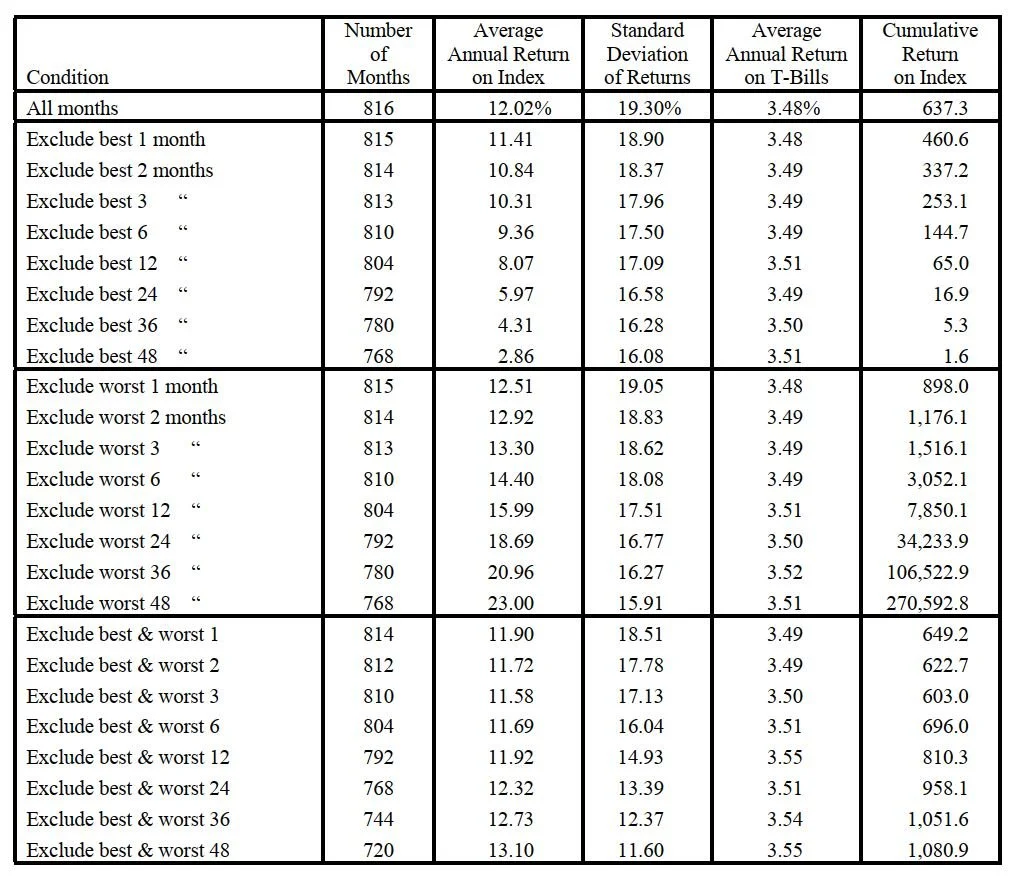

Findings for the Years 1926 - 1993

The study found that by being "out of the market" for just a few months during this 68-year period, the risk and reward of the index changes dramatically if the months which were missed were those with either the highest or lowest returns - that is, the best or the worst.

In the full span of these 816 months from January 1926 to December 1993, the index had an average annual return of 12.02%. The cumulative gain on $1.00 invested at the start (January 1926) was $637.30. Records show that the single best month was April 1933, with a return of 38.3% Eliminating only that month would reduce the cumulative gain to $460.60 and cut the average annual return to 11.41%.

As the number of best months eliminated is gradually increased, the rewards of investing fall sharply. With the 12 best months eliminated, the cumulative return is $65.00; with the best 24 months eliminated, the cumulative gain on the $1.00 stake is $16.90.

Eliminating the best 48 months -- 5.9% of the 816 months -- lowers the average annual return to 2.86%, a rate below that of Treasury bills for the study period. As a result, the cumulative gain on $1.00 is $1.60, compared to $637.30 for the full span. Besides the small returns, an investment in the index for the less-rewarding 768 months would have incurred 83% of the risk of being in the stock market for all 816 months.

Excluding the worst months, but not the best months, also produces improvement in returns. Without the single worst month -- which was September 1931 when the market plunged 29% -- the cumulative gain rises to $898.00 and the average annual return improves to 12.51% from 12.02%. Dropping the 48 worst months provides an average annual return of 23.00% and multiplies the cumulative gain 425 times to $270,592.80. Risk is 16% less than that of the full period.

If both best and worst months are excluded, the changes that result are narrower than excluding only the best or only the worst months. In fact, the average annual returns decline when the 12 best and 12 worst months are excluded. The cumulative gain also declines when the two best and worst, and the three best and worst months are eliminated. When the 48 best and 48 worst months are taken out of the calculations, the average annual return rises to 13.10% and the cumulative gain to $1,080.90.

(See Table A for data and descriptions of rate of return calculations)

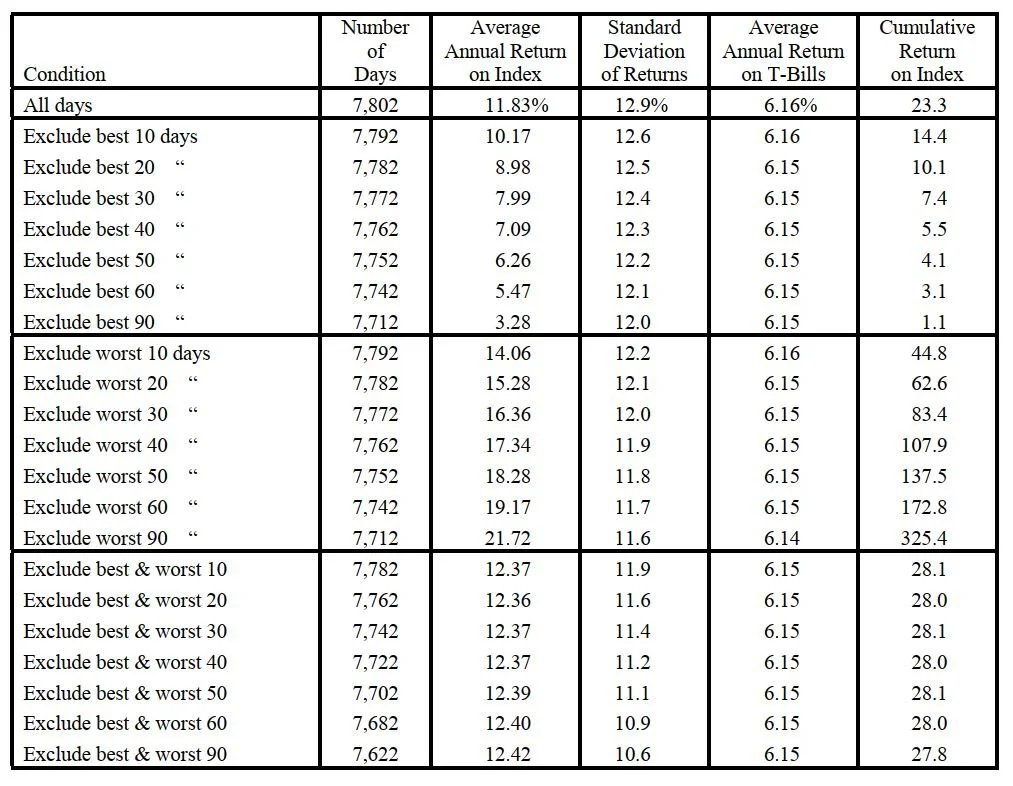

Findings for the Years 1963 - 1993

For the 31 years from January 1963 through December 1993, the study focused on the daily data that was available for this period. As in the longer period, eliminating a few of the extremes, in this case best or worst days, radically changed the outcome.

For the entire 31 years of daily data, the index had an average annual return of 11.83% and a cumulative gain of $23.30 on $1.00 invested at the start of the period. Excluding the 10 best trading days, or one-tenth of one percent (0.1%) of the total, reduces the average annual return to 10.17% and the cumulative gain to $14.40 -- a reduction of 38%.

As additional best days are eliminated, returns fall substantially. For example, eliminating the best 90 days, or 1.2% of total days, produces a cumulative return of $1.10 on $1.00 invested 31 years earlier. It also reduces the average annual return to 3.28%, which is 47% less than the 6.15% return on Treasury bills for the period. To put it another way, the data show that an investment in the index for these 7,712 days incurred 93% of the risk of a full-period stock market investment, for which the investor would have received barely half of the reward of an investment with no significant risk.

Excluding the worst 10 days raises the average annual return to 14.06% and the cumulative gain to $44.80, an increase of 92%. With the worst 90 days eliminated, the cumulative gain is $325.40 -- 14 times higher than the full-period gain, and the average annual return is 21.72% compared with 11.83% from continuous stock market investing, i.e. buy and hold.

The study found that eliminating both the 10 best and 10 worst days, the 20 best and worst, etc., up to 60 days, raised the cumulative return to a narrow range of $28.00 to $28.10. With the 90 best and 90 worst days excluded, the cumulative return was $27.80. In the last case, although the investor would have missed the 2.3% of the trading days that had the highest and lowest returns, an investment in the index nevertheless incurred 82% of the risk of being "in the market" for the full period.

(See Table B for data and descriptions of rate of return calculations.)

Perfect Timing: Payoff and Profitability

Let us examine the cases of the perfect market timer and the inept market timer. The perfect timer is always right, anticipating down markets and switching into short-term Treasury bills whenever market returns are negative. The inept timer holds the market portfolio when the market returns are negative and Treasury bills when the market returns are positive.

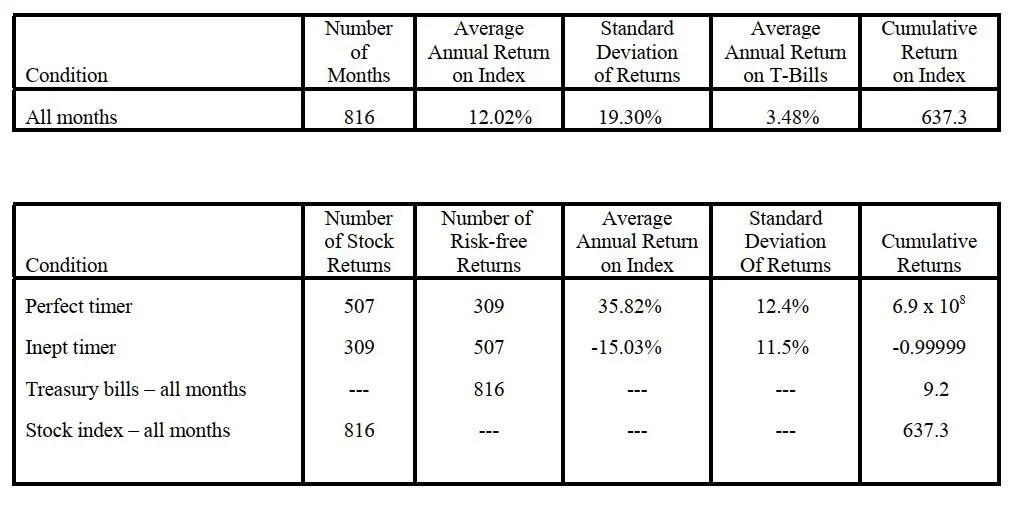

Monthly data shows that the perfect timer would have turned a $1 investment in January 1926 into $690 million in December 1993. In contrast, the inept timer would have turned $100 million into $1,000 by December 1993. In comparison, a $1 investment in the market index would have grown by $637.30, while $1 invested in Treasury bills would have grown by $9.20. (See Table C)

What about the investors who were neither perfect nor inept? They may have tried to avoid the downswings during either study period and, instead, missed the few periods that produced most of the rewards. As a result, they came away with only a trifling gain.

These unsuccessful market timers experienced stock market volatility for almost all of a study period, so their meager returns did not compensate them for their risk. In fact, their misfortune in missing the few major opportunities that came along added investment insult to financial injury. In other words, by not being invested for the infrequent upswings, these particular market timers were paid for their high risk with a rate of return below that of an investor in Treasury bills. And the T-bill investors essentially had no market risk at all.

The financial results of perfect timing are indeed attractive. Yet they are virtually unreachable. In terms of the monthly data, for example, if a market timer is right 50% of the time, the probability of executing a perfectly timed investment strategy is 0.5 raised to the 816th power -- or nearly zero.

Conclusion

The impact of the study can be seen in what it found when it measured the size of the windows of opportunity at which market timing aims. They are quite small.

Two examples illustrate the point. Between 1926 and 1993, more than 99% of the total dollar returns were "earned" during only 5.9% of the months. For the 31-year period from 1963 to 1993, a scant 1.2% of the trading days accounted for 95% of the market gains.

While stock market history teaches us that some market timing techniques are better than others, the study nevertheless shows that -- to optimize returns -- a constant, intensive, and highly accurate approach is needed. Indeed, the data assembled and the calculations done provide compelling evidence that even a few lapses may thwart the accumulation of wealth for which a stock market participant may elect to take on the risk of equity investing. In other words, the data show that the returns from trying and failing to be an outstanding market timer are highly likely to be less than simply owning Treasury bills.

The implications of this study could well be critical for the average investor. By being "out of the market" for as few as even one or two of the best performing months or days over several decades, a portfolio's return is significantly diminished. Since the study also shows that most of the damage to portfolio performance occurs during a very few months or days, if an investor could avoid such periods, the result would be to sidestep losses and substantially grow one's portfolio.

But one look at the data and the realities of the stock market makes it abundantly clear that such a course of action would expose the investor to investing's biggest -- and potentially most costly -- "if."

Table A

Returns excluding extreme monthly observations for period January 1926 to December 1993 (68 years).

The value-weighted index of NYSE, AMEX, and NASDAQ stocks is used to measure the market returns. All returns and standard deviations are annualized by compounding the arithmetic average of monthly returns.

Cumulative return measures the holding period dollar returns to $1 invested at the beginning of the period. Hence, the cumulative return of 637.3 means that $1 grows to $638.30 if invested continuously from January 1, 1926 to December 31, 1993.

Table B

Returns excluding extreme daily observations for period January 1, 1963 to December 31, 1993 (31 years).

The value-weighted index of NYSE, AMEX, and NASDAQ stocks is used to measure the market returns. All returns and standard deviations are annualized by compounding the arithmetic average of the daily returns.

Cumulative return measures the holding period dollar returns to $1 invested at the beginning of the period. Hence, the cumulative return of 23.3 means that $1 grows to $24.30 if invested continuously from January 1, 1963 to December 31, 1993.

Table C

Performance of Perfect Timer/Inept Timer for period January 1926 to December 1993.

Perfect timer invests in the value-weighted index when returns are positive and in one-month Treasury bills when market returns are negative. From January 1926 to December 1993, there were 507 months when the value-weighted index had positive returns and 309 months when the value-weighted index had negative returns.

The inept timer does the converse, investing in Treasury bills when market returns are positive and in the market when market returns are negative.

© Copyright 1994, Towneley Capital Management, Inc.

Permission to reproduce in whole or in part may be granted upon request provided appropriate credit is given to Towneley Capital Management